BRICS is stitching together a parallel economy. Does Washington’s sanctions recipe still work when U.S. leverage is no longer uncontested?

3 Narratives News | October 21, 2025 · Updated for clarity and sources

Intro

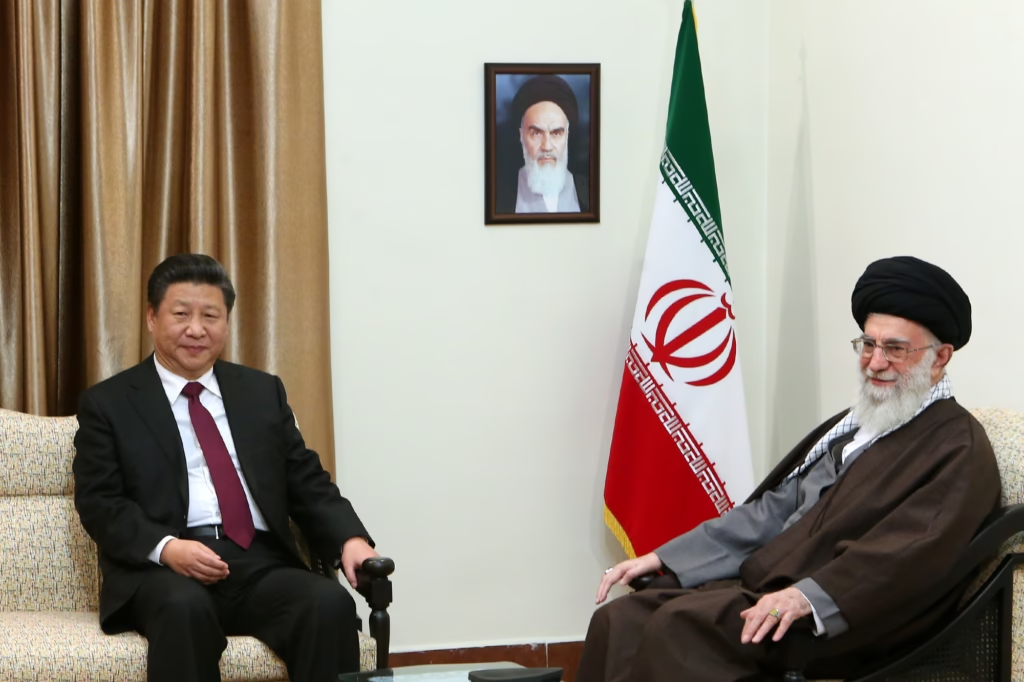

“The U.S. president proudly says they bombed and destroyed Iran’s nuclear industry. Very well, keep dreaming! … What does it have to do with America whether Iran has a nuclear industry or not?” — Ayatollah Ali Khamenei, Oct. 20, 2025

The line was theatrical, but the stakes aren’t. Iran is leaning into BRICS and other non-Western channels just as the United States doubles down on snapback sanctions and deterrence. For readers coming fresh to this story, we sketch the history and then ask the simple question with complicated answers: what have U.S. sanctions actually achieved, what can BRICS change, and where does this go after a bruising June flare-up and a week of barbed rhetoric?

Context

Why this matters: For roughly twenty years, Washington’s core goal has been simple to say and hard to achieve: stop Iran from getting a nuclear weapon without starting a war. The logic is blunt. The more countries with nuclear arms, the higher the odds of accident, miscalculation, or use. Western governments also see Iran as uniquely risky because of anti-Israel rhetoric and support for armed groups such as Hezbollah and other regional proxies. In their view, Iran is the last country that should be anywhere near a bomb.

The U.S. playbook: squeeze first, talk later. Sanctions raise the economic cost to Iran, while diplomacy tries to cap uranium enrichment and keep inspectors on the ground. That formula worked briefly under the 2015 nuclear deal (the JCPOA), which swapped limits and monitoring for relief. When the U.S. left the deal in 2018, the “maximum pressure” approach returned.

What just happened: In June 2025, a twelve-day flare-up included strikes on Iranian nuclear sites and a tightening of penalties. On October 20, Iran’s Supreme Leader, Ayatollah Ali Khamenei, mocked Donald Trump’s claim that the U.S. had “destroyed” Iran’s nuclear program and rejected talks “under bullying.” The same day, Tehran moved to void a cooperation arrangement with the U.N. nuclear watchdog, cutting outside visibility into its activities.

How Iran’s economy is coping: it’s under strain. The IMF’s 2025 snapshot shows real growth around 0.6% and inflation near 42%—numbers that translate into everyday hardship for ordinary Iranians.

A new challenge to American-led dominance: sanctions and other tools of U.S. economic influence are now being tested by a rising coalition designed to chip away at Washington’s control of global finance—BRICS. The bloc began with Brazil, Russia, India, China, and South Africa, but has since expanded to include Iran and other emerging powers, now representing roughly half of humanity and a growing share of global GDP.

At its core, BRICS is more than a trade alliance. It is an effort to build a world economy that no longer depends on the U.S. dollar, the Western banking system, or Washington’s approval. Its members openly condemn “unilateral sanctions” and are developing new ways to settle trade in their own currencies. For nations long squeezed by American or European pressure, this offers both practical relief and political symbolism—proof that global power can shift.

China showcased that ambition during its recent commemoration of the end of World War II, presenting itself—alongside Russia and India—as an architect of a new world order rising outside Western control. (See our related report: China’s Tianjin Summit: Xi, Modi, and Putin on a New World Order.)

Narrative 1 — Inside Washington’s Playbook

When the United States re-imposed sanctions in 2018, then-Secretary of State Mike Pompeo described the goal bluntly:

“We want the regime to understand that its behavior has enormous costs. Our aim is deterrence without war.”

(Statement at the Heritage Foundation, May 21, 2018.) That phrase—deterrence without a shooting war—has since become shorthand across Republican and Democratic administrations alike.

The logic is straightforward: make the path to a nuclear weapon too expensive and too visible to be worth the risk. Sanctions strike at two arteries of Iran’s economy—oil exports and banking access—while diplomacy, when available, offers limited relief in exchange for inspections and caps on uranium enrichment. The approach has endured because the objective hasn’t changed: keep the pathway to a bomb narrow, time-consuming, and observable through the International Atomic Energy Agency (IAEA).

The 2018 impact, by the numbers

- According to the International Monetary Fund, Iran’s GDP contracted by 6% in 2018 and by another 6.8% in 2019—a combined shrinkage of more than 12% in two years.

- Oil exports collapsed from roughly 2.5 million barrels per day in 2017 to under 500,000 barrels per day by mid-2019 (U.S. EIA and Reuters data).

- The Iranian rial lost over 60% of its value within months of renewed sanctions; annual inflation surged above 40%.

- Foreign direct investment fell by over 90% between 2017 and 2019 as European and Asian firms—TotalEnergies, Siemens, Hyundai Engineering, and others—pulled out to avoid U.S. penalties.

By 2025, the pattern continues in smaller cycles. Sanctions forced Iran to rely on steep discounts, middlemen, and “shadow fleets” of tankers that hide or relabel cargo. China remains the main buyer through independent “teapot” refiners, but its appetite rises and falls with enforcement. Reuters (June 27, 2025) estimated Chinese imports near 1.46 million barrels per day at the June peak—still below Iran’s pre-sanction capacity.

Sanctions have crippled revenue but not erased capability. Iran retains trained nuclear scientists and most of its infrastructure; enrichment can restart when funds and political will align. That is why Tehran’s October 20, 2025, move to void its cooperation agreement with the IAEA matters: it strips away inspectors just as tensions climb.

From Washington’s standpoint, the response is continuity, not novelty. Officials at the State Department and National Security Council now frame policy around three fixed points: deterrence, visibility, and negotiation if compliance returns. In the words of National Security Advisor Jake Sullivan earlier this year, “Sanctions remain one of the few tools that can change behavior short of conflict.” (Press briefing, March 14, 2025.)

Narrative 2 — Tehran’s BRICS Bet

When Washington re-imposed sanctions in 2018, Tehran’s message hardened just as publicly. In a televised address on May 23, 2018, Ayatollah Ali Khamenei said:

“America has violated its promises once again. We will resist. They think pressure will bring us to our knees; they are wrong.”

(IRNA transcript, May 23, 2018.) That defiance set the tone for the next seven years: Iran would look east for partners, trade through shadows if necessary, and join any alliance willing to blunt U.S. power.

Why BRICS became the alternative. Foreign Minister Hossein Amir-Abdollahian called Iran’s 2024 admission into BRICS “a strategic shift that opens breathing space for sanctioned economies.” (Press briefing, Johannesburg Summit, Aug. 2024.) The logic was simple: if the United States controlled the dollar and the global banking system, Tehran would help build another one. BRICS already united Brazil, Russia, India, China, and South Africa; its expansion now includes Iran, Saudi Arabia, Egypt, Ethiopia, and others—together accounting for nearly 45% of the world’s population and about 36% of global GDP (IMF World Economic Outlook 2025).

Trade and sanctions leakage by the numbers.

- Oil exports: Despite sanctions, tanker-tracking firms (Kpler/Vortexa) estimate Iranian shipments averaging 1.3–1.5 million barrels per day in mid-2025, mostly to China. That’s triple the 2019 trough of <500,000 bpd but still below pre-sanction highs. (Reuters, June 27, 2025.)

- Currency and reserves: The Central Bank of Iran reports foreign-exchange reserves rebounding from $12 billion in 2019 to roughly $26 billion by 2024, largely through non-dollar trade with Russia and China. (CBI annual report 2024.)

- Non-oil trade: Bilateral commerce with China topped $16 billion in 2024, a 15% increase over 2022 (Customs Administration of China).

- BRICS finance: The bloc’s New Development Bank announced in July 2025 it would begin lending in local currencies; Iran applied for project eligibility that month (NDB press release, July 15, 2025).

Diplomatic posture. At the October 2025 BRICS coordination meeting, Iran’s envoy Mohammad Jamshidi argued that “the era of unilateral coercive measures is ending; half the world will no longer trade under threat.” (Statement to BRICS/SCO Forum, Moscow, Oct. 5, 2025.) Moscow backed that line two weeks earlier, calling renewed U.N. sanctions on Iran “illegal and self-defeating.” (Reuters, Oct. 2, 2025.)

What this means in practice. BRICS gives Tehran buyers for discounted barrels, technology exchanges with Russia and China, and the symbolism of belonging to a bloc that rejects U.S. rules. Yet the relief is partial: insurance, finance, and shipping still run largely through Western systems, and most multinationals avoid secondary-sanction risk. The result is a sanctions regime that leaks rather than collapses.

The broader narrative. Iran’s alignment with BRICS is less ideological than existential. It transforms sanctions from an American chokehold into a slow-bleed contest. For now, that contest favours patience over concession. As President Masoud Pezeshkian said after joining BRICS: “If the West closes one door, we will open five to the East.” (State TV interview, Jan. 2025.)

Narrative 3 — The Silent Story

Lost beneath the diplomacy and data is a deeper anxiety: the systems meant to prevent nuclear disaster are starting to fray. Verification, once a shared safeguard, has become a bargaining chip. When inspectors lose access, suspicion fills the vacuum—and suspicion is what starts wars.

After the June strikes on Iranian nuclear sites and the October breakdown of IAEA cooperation, the world’s margin for error has shrunk to a hairline. If Iran moves unseen and Israel responds preemptively, the confrontation could pull in powers already divided by the Ukraine and Gaza conflicts. Each new crisis unfolds against a background of weaker institutions and louder rival blocs.

Iran’s economy remains fragile—inflation above 40%, investment scarce, capital fleeing—yet its nuclear knowledge base is intact. That combination creates a dangerous paradox: a state too pressured to prosper but too capable to ignore. The IMF data capture the numbers, but not the fear among ordinary Iranians who see sanctions as punishment without end or purpose.

For Washington, partial enforcement now buys time, not safety. For Tehran, the BRICS connection buys breathing room, not trust. And for the rest of the world, the question has shifted from whether Iran can build a weapon to who can stop the next spiral of escalation when Western leverage is fading and BRICS has other priorities.

As the nuclear balance nudges eastward, the old deterrence architecture looks fragile. Who, in this new order, has both the power and the will to keep humanity from sleepwalking into a nuclear accident? That is the question we began with—and the one that will define not only Iran’s future, but the world’s.

(For related coverage, see When Hope Meets Reality: The Jarring Dawn After Trump’s 20-Point Peace Deal and Who Polices Gaza Now? Ceasefire Euphoria Meets a Brutal Reality Check — both explore how shifting power blocs are redrawing global rules.)

Key Takeaways

- Khamenei’s “keep dreaming” rebuff coincided with Tehran’s voiding a cooperation deal with the IAEA, reducing visibility into Iran’s program. Reuters · Reuters

- Sanctions still bite at home—IMF shows ~0.6% growth and ~42% inflation for 2025—but isolation is no longer airtight. IMF

- BRICS softens the edges through political cover, off-Western buyers, and non-dollar experiments; plumbing remains incomplete. Bloomberg · CGTN

- Oil is the pressure valve and the vulnerability: China’s intake rises and falls with risk and enforcement. Reuters

Questions This Article Answers

- What did Khamenei say, and why did he say it now?

- What have U.S. sanctions tried to achieve since 2018?

- How does BRICS change the effectiveness of sanctions in practice?

- Why does the IAEA cooperation breakdown raise the risk of miscalculation?

- Could a monitored cap exist in a more multipolar market?

External Sources

- Reuters: Khamenei’s remarks

- Reuters: IAEA cooperation voided

- IMF: Iran

- Bloomberg: BRICS posture

- Reuters: China’s intake of Iranian oil

- Asia Times: covert lifeline risk

- EIA/Vortexa PDF